In a financial landscape defined by shifting correlations and rising debt, the “safe” portfolios of the past have become the risks of the future.

For decades, the 60/40 portfolio—60% stocks and 40% bonds—was the gold standard for risk-adjusted returns. It relied on a simple premise: when stocks fall, bonds usually rise, providing a cushion. However, as we move through 2025 and into 2026, the fundamental relationships between these asset classes have begun to fracture.

Data from major financial institutions indicates that equities and bonds are increasingly moving in tandem. In an environment of persistent inflation and fiscal expansion, both assets can suffer simultaneously. At MAQ Investments, we believe true wealth preservation requires a pivot toward tangible, asset-backed security.

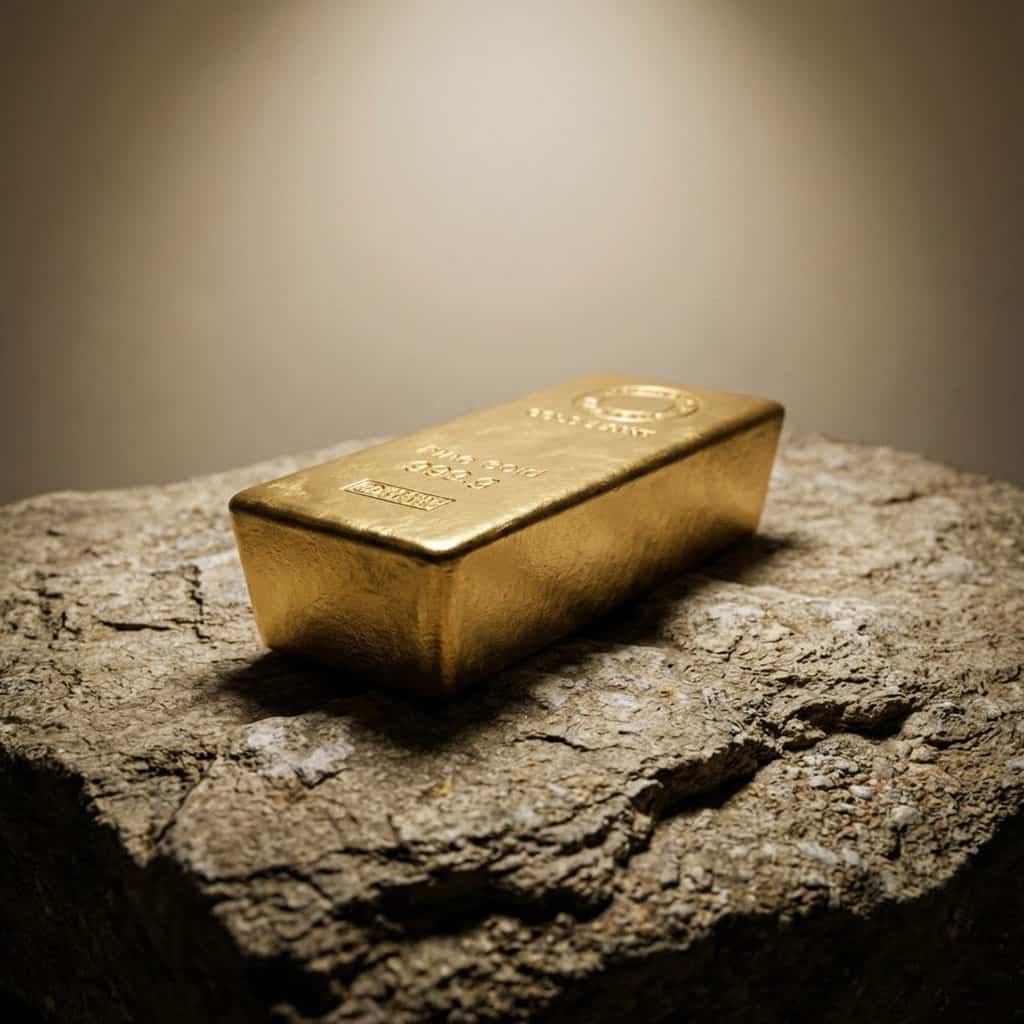

The Case for Real Assets

We are entering a new regime of structural inflation and geopolitical instability. In this environment, “paper” assets (stocks and bonds) are vulnerable to currency debasement and policy shifts. Real Assets—specifically physical gold and strategic real estate—provide the necessary hedge.

1. Sovereign Security

Gold is not just a commodity; it is a store of value that has outlasted every fiat currency in history. With forecasts pushing gold towards $5,400 by 2027, holding a portion of wealth in physical bullion offers a “sovereign hedge” against systemic risk. It is the ultimate form of portfolio insurance.

2. Uncorrelated Returns

Diversification is the only “free lunch” in finance. By incorporating tangible assets that have low correlation to the S&P 500 or bond yields, investors can reduce portfolio volatility. In 2025, gold outperformed major equity indices, proving its value as a distinct, non-correlated asset class.

3. Shariah-Compliant Values

Our investment philosophy is rooted in ethical, asset-backed participation. We do not engage in speculation or highly leveraged trading. Instead, we focus on creating tangible wealth aligned with Shariah-compliant values—ensuring every investment is grounded in physical reality.

The MAQ “Investment Circle”: A Clear Path to Prosperity

Wealth management is not a transaction; it is a process. At MAQ Investments, we utilize a proprietary four-step methodology designed for clarity and security, ensuring your asset allocation aligns with your long-term goals.

| Step | Phase | Description |

| 01 | The Understanding | Comprehensive consultation to analyze liquidity needs, risk tolerance, and generational goals. |

| 02 | The Plan | Developing a bespoke strategy that integrates physical gold trading and wealth advisory. |

| 03 | The Acquisition | Facilitating the secure execution of asset purchases (Gold/Real Estate) with full insurance and verification. |

| 04 | The Growth | Ongoing, transparent reporting and review to ensure the portfolio adapts to changing market conditions. |

Conclusion: Build on Solid Ground

In 2026, do not leave your legacy to the whims of correlated paper markets. Build your portfolio on a foundation of tangible value.Start the conversation today. Contact MAQ Investments to schedule a consultation with our strategic advisors and discover how the Investment Circle can secure your financial future.